RSWM Ltd announces its Q1FY23 Financial Results

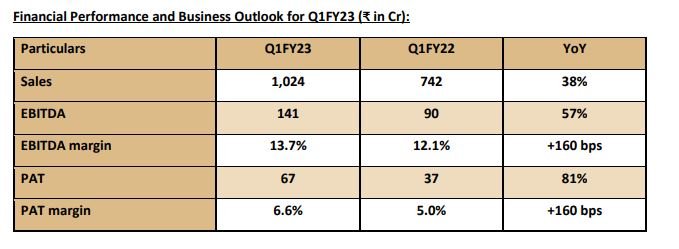

- Total sales recorded for Q1FY23 stands at ₹1,024 Cr, up 38% (YoY)

- Export recorded sales ₹286 Cr

- EBITDA for Q1FY23 stands at ₹141 Cr, up 57% (YoY)

- PAT stands at ₹67 Cr, up 81% (YoY)

New Delhi, 08th August 2022: RSWM Ltd. (BSE: 500350/NSE: RSWM), RSWM is one of the largest manufacturers and exporters of value-added synthetic, mélange, blended spun yarns, and denim fabric from India, today announced its financial results for the Q1FY23 ended 30th June 2022.

Business Update:

- Upbeat sentiments in domestic markets drives consumer demand and market witnessed a buoyant demand.

- School uniform season increased demand for yarn, while wedding season increased footfalls on retail end.

- Domestic demand witnessed strong growth up 62% YoY

- Export sales in-line with Q1FY22 at ₹286 Cr, exports-maintained momentum YoY despite of recession concern

- Cost optimisation program helped in maintaining profit margin

- Strong realization led to PAT growth at ₹ 67Cr up 81%

- Higher raw material prices are getting absorbed by end users; but it still continues to remain a concern for the industry

- Projects, 30k spindles yarn capacity at Gulabpura, Denim Fabric Capacity at Banswara and New knitting unit at Banswara undertaken during last year, have started commercial production w.e.f. 1st July 2022

- Knits is progressing well in order booking

- Expansion of 51k spindles at Banswara is progressing well

- Debt to equity stands at 0.89 as on 30th June, 2022

Commenting on the results, Mr. Riju Jhunjhunwala, Chairman & Managing Director of RSWM Ltd. said, “For Q1FY23 our focus on execution and cost controls have helped us achieve a strong Q1 performance, where we have increased revenues and improved margins YoY. We have commenced our knitting unit and other expanding capacities in Gulabpura and Banswara, this will put us in a strong position for the coming quarters. While commodity prices still continue to remain our concern, the cost reduction program and strong positioning is helping us in maintaining profit margin. We remain committed to future growth plans with focus on enhancing our product portfolio, geographical reach and improving efficiencies of higher return on investments. We now look into the future with excitement and confident in our ability to drive continuing value for our stakeholders by delivering the strategic business plan.”